Positive ore test results at Mustang’s graphite-vanadium project

Published 12-JUN-2018 15:28 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Finfeed presents this information for the use of readers in their decision to engage with this product. Please be aware that this is a very high-risk product. We stress that this article should only be used as one part of this decision-making process. You need to fully inform yourself of all factors and information relating to this product before engaging with it.

Mustang Resources (ASX:MUS) has informed the market it has received strong results from preliminary ore sorting testwork conducted on drill core from its Caula Graphite-Vanadium project in Mozambique.

The testwork demonstrated that the Caula ore is highly amenable to sensor-based ore sorting, showing that an ore sample with no visible waste could be split into high-grade and low grade streams.

Both X-Ray Transmission and Conductivity-based (EM) sorting were evaluated through testing, with the EM sorting producing the best result for MUS. EM sensors assess the amount of electrically-conductive mineral (for MUS’s purposes, graphite) in each rock particle. The company also stated that vanadium values are closely associated with graphite and show a similar response to sorting.

Sorting ore saves a company costs by rejecting waste rock and low-grade ore ahead of expensive processing steps such as milling and froth flotation.

In many cases, sorting delivers additional environmental benefits to projects due to reduced tailings volumes, enhanced tailings storage stability and other factors. High capacity, sensor-based ore sorting is an emerging technology which can deliver enormous value, particularly when considered for a new mining project.

The preliminary ore sorting test work was conducted by specialists TOMRA, at its Test and Demonstration Centre at Castle Hill, NSW Australia.

In short, the tests found that in a full-scale mining operation, EM sorting would efficiently reject barren waste with minimal loss of graphite or vanadium values; successfully split a moderate-grade ore sample with no visible waste into high-grade and low-grade fractions; and, the potential to use ore sorting to upgrade graphite and vanadium grades.

It should be noted it is still early stages here, so investors should seek professional financial advice if considering this stock for their portfolio.

The results demonstrate the potential to increase production rates without increasing the plant size and to reduce operating costs. With such strong results, TOMRA has recommended a larger-scale formal test work program.

TOMRA has an extensive record in the mining industry relating to sensor-based sorting installations operating at feed rates ranging up to several hundred tonnes per hour, with full automation and thus very low costs per tonne processed.

Project background and test work specifics

The Caula Project is located along strike from Syrah Resources’ (ASX:SYR) world-class Balama graphite project in Mozambique.

The sample selected for the ore sorting test work was a continuous portion of quartered NQ diamond drill core from 58m to 88m downhole.

The sample was selected as a representation of fresh ore with moderate grades of graphite and vanadium and no visible barren rock intersections.

The quarter core sample, total weight of 66kg, was broken into approximately 50mm lengths, then split into two portions using a rotary riffle. Subsequently, one of these portions, with a weight of about 30kg, was sent to the TOMRA Test and Demonstration Centre.

At TOMRA, the sample was screened at 16mm to remove ‘fines’ ahead of sorting tests. The ‘screen oversize’ was then subject to sorting tests on both XRT and EM based machines.

Analysis samples were then split out and sent for graphite analysis, multi element XRF analysis and semi-quantitative XRD mineral analysis.

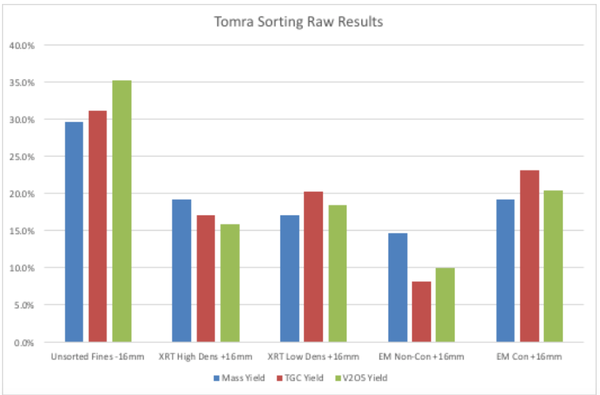

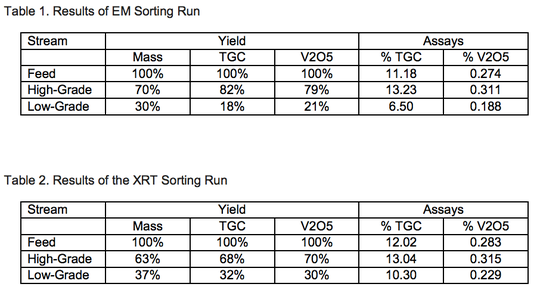

The mass split and the distribution of contained graphite and vanadium between the five samples is shown below.

As shown above, EM sorting achieved greater levels of separation of graphite and vanadium values than the XRT sorting. Comparative results are also shown in the tables below.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.